In today’s technology world, the degree of competition and complexity in any business is very high. In the telecom business in particular – with the rise of 4G, 5G, the cloud, NFV, distributed architectures – the network complexity has increased and operators are turning to managed services to control operational costs and their IT and network environments.

Managed services have the ability to manage the “end to end” customer solution and proactively report issues and faults. It also ensures the restoration is done within the committed service level agreements.

In this challenging context, this case study shows how operators can benefit from partnering with a specialized provider of telco managed services such as R Systems.

The use case sets the business scenario for extensive automation of telecom network operations to enhance network visibility and monitoring, failure pattern recognition and proactive network fault detection. The end benefits lie in improved network performance, reduced network operation costs, better subscriber experience and reduced churn.

Low network performance and KPI auditing

Our client, a western European tier-1 mobile operator, was experiencing low network performance and requested R Systems’ support in performing an audit of network KPIs and ultimately improving performance and subscriber experience.

R Systems provides telco managed services to identify inefficiencies and gaps in automated monitoring platforms of telecom networks and services resulting in proactive operations at reduced cost and better subscriber retention. Examples include:

- proactive detection of network congestion and outages in telecom networks;

- proactive localization of subscribers with degraded telecom service performance;

- automated localization and diagnosis of network faults reducing OPEX by up to 70%.

Comprehensive telco managed services

R Systems applied this comprehensive approach of telco managed services to this project including 3 phases: the audit of client’s existing network KPIs, introduction of new KPIs for enhanced visibility over the network and subscriber service performance as well as automation of the entire chain of network operations.

The first step – the audit of the KPIs in place – was performed by R Systems using the operator’s monitoring and reporting platforms: Polystar (network analyzer), Subtonomy, Grafana.

The network audit revealed inaccuracies in performance indicators so R Systems proposed a series of corrective solutions such as additions of missing call failures and introduction of new types of network indicators.

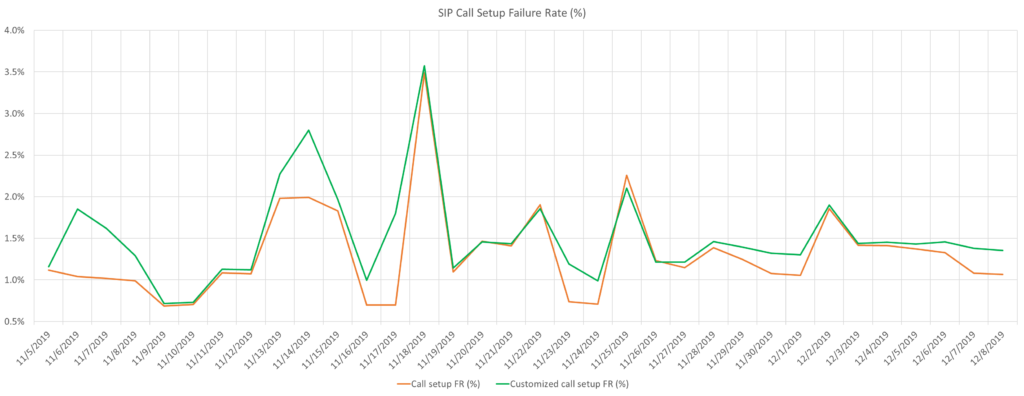

The chart below emphasizes one example of KPI discrepancies identified in the network analyzer: the orange line shows the initial KPI values and the green line shows the customized KPIs. The correction of such discrepancies is essential in detecting all network failures in order to take the appropriate measures.

Another contribution is on network congestion; this is typically detected based on node or link average utilization but heavy aggregation and averaging can dilute traffic peaks which triggers latency in the upgrade of network capacity.

To enable proactive measures and quick upgrades in network capacity, R Systems implemented a technical solution which shows early signs of capacity congestion and allows to build customized KPI alarms for congestion detection ahead of time.

In more technical details: the early signs of capacity congestions are provided by the network KPIs (e.g. % discarded messages, delay, call drop rate, % timeouts) which are very sensitive to network load. For example, the percentage of timeouts increases by 15% when network load increases from 80% to 82%. The building of customized KPI alarms is enables by SIP error codes related to N-KPI for congestion (e.g. Timeout).

R Systems took one step further and proposed the introduction of new KPIs – such as subscriber location and KPI analytics – to enhance the operator’s visibility over the localised service degradation specific to a group of customers.

A relevant scenario is where CRM and CEM tools aggregate and average subscriber analytics network-wide, which dilutes visibility on specific subscriber groups. For example, call drop rate reported at country level could hide issues related to a customer group in a specific geographical area; if no alarm is raised the operator is blind.

To solve situations as above, R Systems introduced de-average KPI for each subscriber and access node. This allows the introduction of more relevant and sensitive KPI like “subscribers with call drop above 5%” enriched with geo location and IMSI to identify for subscribers with most degraded service performance.

Using the R Systems services, the operator is now able to easily detect all subscribers with degraded performance, take corrective actions proactively. Newly created de-average KPIs are automated in dashboards and reports.

Automation of the entire chain of network operations

The third phase of project consisted in the automation of the entire chain of network operations including network diagnosis, ticketing, alarms, root cause analysis and resolution.

Typically, 70% of the effort with incident management is root cause analysis to identify and fix faults. VoLTE and cloud issues specifically are complex end-to-end (E2E) cross-domain investigations requiring many resources and reducing proactivity. Incorporating extensive E2E telecom capabilities R Systems came up with a creative solution for failure pattern recognition. The automated solution is based on pre-defined call flows database and machine learning, and identifies the likely network element at fault (e.g. CSCF, MME, SBC for VoLTE) as well as the likely fault.

The solution brings two main benefits from the client: reduced troubleshooting time by up to 70% and reduced network operation costs.

The presented case study comes in support of an industry trend where CSPs turn to telecom managed services to reduce their costs in business operations, to concentrate more on essential business exercises, cut down business operations risks, and upgrade operational effectiveness. According to recent industry reports, the telecom managed services market size is expected to grow from USD 11.90 billion in 2017 to USD 22.58 billion by 2022, at a Compound Annual Growth Rate (CAGR) of 13.7%.